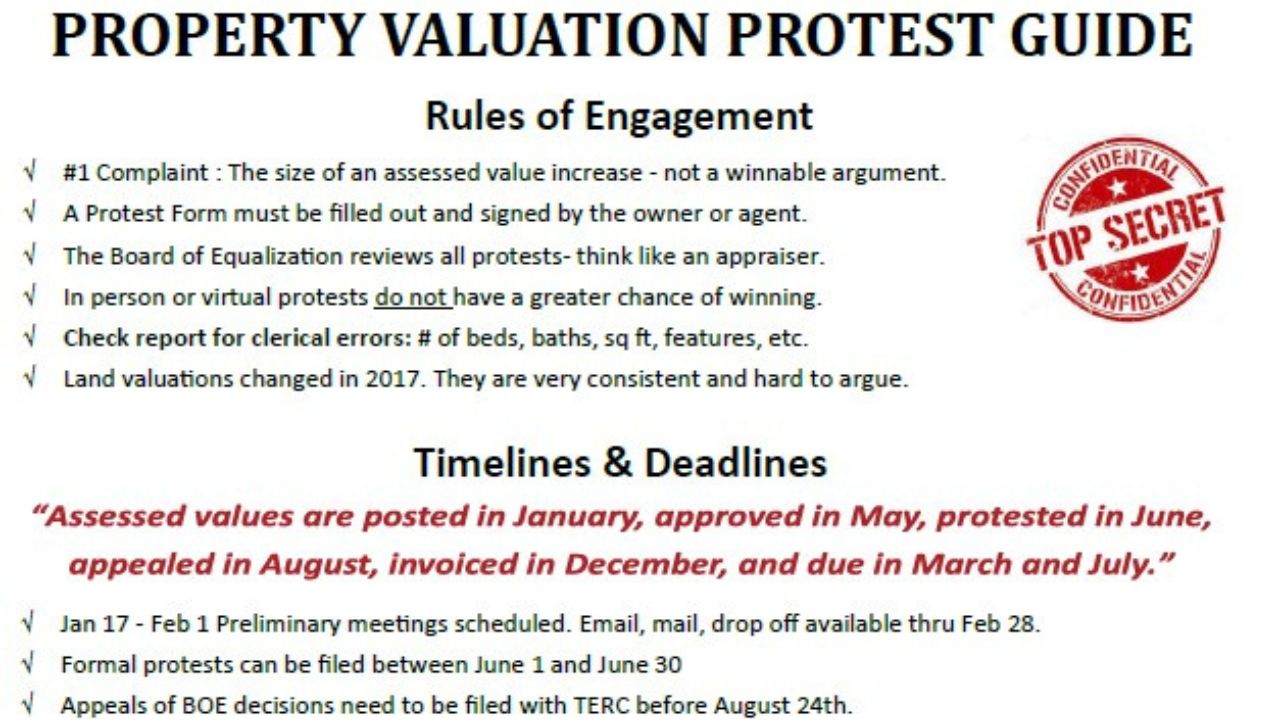

In my recent webinar I discussed three winning strategies to protest your property tax value assessment with the county assessor. This is a formal process only allowed during a certain period of time where you can gather new information to lower your tax value and ultimately pay lower property taxes. Over the course of twenty plus years selling real estate I have developed a one-of-a-kind Property Tax protest Guide which I am sharing with the full public for the first time. I'll also explain six rules of engagement and the timelines used in this process. Attorney's charge big bucks to do this for commercial properties. I'll show you how to do this from your home computer. By following my three steps, you can successfully protest your property tax value assessment and pay lower property taxes. Property Tax Protest Guide 2023

- How to Buy and Sell a Home at the Same Time

- Weekly Omaha Home listings and Coming Soon Homes Under $300,000 | June 20, 2025

- Douglas County Property Tax Protest Guide

- 🗓️ When Is the Best Time to Buy a Home in Omaha?

- Weekly Omaha Home Listings: Signs of a Balanced Market & Top Homes Under $300K | May 9, 2025

Search

Recent Posts

Share My QR |

|

Success!